Financiera Confianza

in the Peruvian

context

In spite of the uncertainty in the international context, the Peruvian economy has experienced a strong growth in the economic and social context. GPD has recorded an average growth of 6.5% between 2008-2012, while at the same time there has been an important decline in poverty, from 42.4% in 2007 to 27,8% in 2011.

These economic and social improvements have had important consequences in the financial system, resulting in higher brokerage and higher access and use of the financial services. This way, the Credit/GPD ratio has risen from 24% in 2008 up to 30% in 2012, while the Bank Deposits/GPD ratio has risen from 29% up to 32%. The number of agencies increased from 2,610 in 2008 to 3,595 in June 2012, and the number of client service points for every 100,000 adult inhabitants increased from 62 to 126 during the same period. The number of debtors went up from 4.0 to 5.2 millions (28% of the adult population) and the number of creditors increased from 11.5 to 17.6 millions (94% of the adult population).

Over the twenty years that have passed since it was founded, Financiera Confianza has focused on approaching Productive Finances to the most disadvantaged people in the centre of Peru. FC has a total of 28 agencies located in six departments of Peru: Junín, Lima, Pasco, Huancavelica, Huánuco and Ucayali. Twenty-four of these agencies are located in districts where more than 20% of their population lives below the poverty line, while 12 are placed in districts with more than 30% poor population.

Financiera Confianza’s holding in the financial system credits is quite important in regions such as Huancavelica (23%), Pasco (11%) and Junín (7%). It is especially important in the microcredits segment (33% in Huancavelica, 36% in Pasco and 17% in Junín). Huancavelica is one of the regions with the highest number of people living below the poverty line (55%), and even below the extreme poverty line (13%). As for the districts, Financiera Confianza's holding is higher in those districts with a higher poverty level, such as: Pampas (Huancavelica), Villa Rica (Pasco), Jauja (Junín), among others.

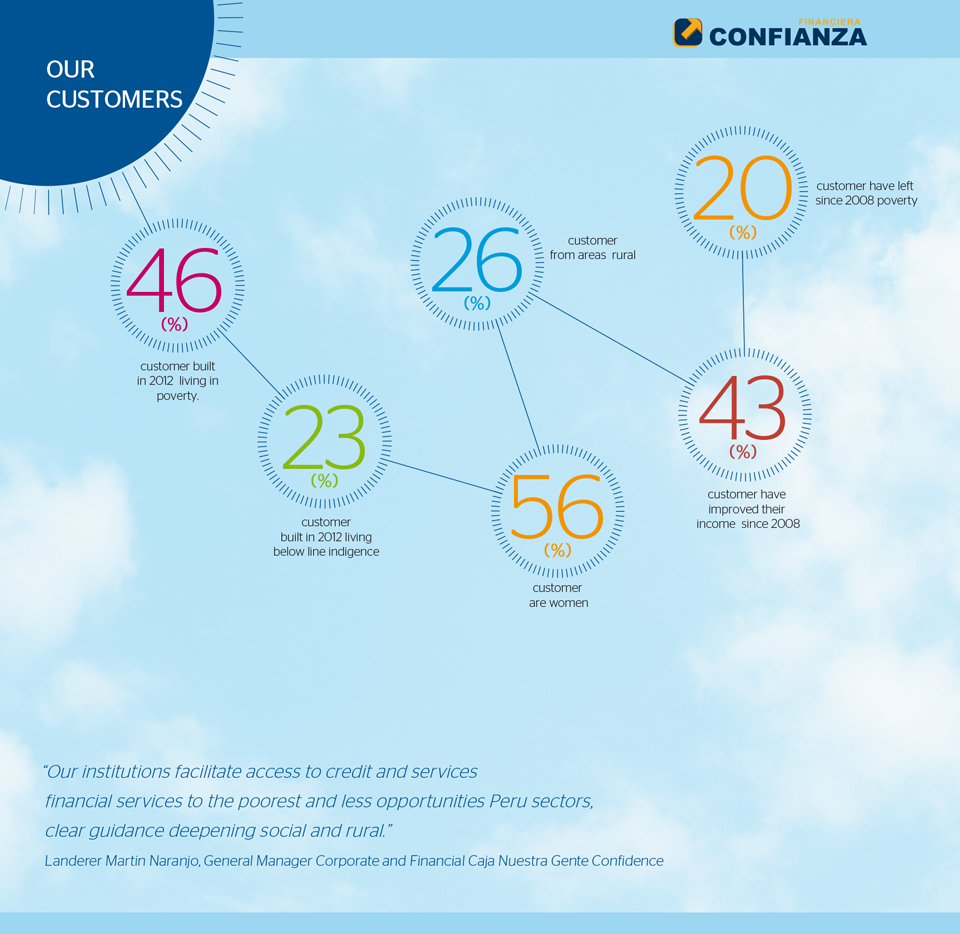

Its recent union and subsequent merger with Caja Nuestra Gente will give rise to the microfinance entity, whose aim is to lead rural microfinances in Peru in order to bring financial products and services to the low-income population as they have no access to the conventional financial system and don't have a chance to make progress. At the end of 2012, the merged entity will have presence in all Peruvian regions. It will have an approximate holding of 0.7% and 0.5% in the total amount of credits and deposits from the national financial system, respectively. This means that the entity is in the fourth place regarding to the microcredit segment, as it has a holding over 6% of the national total.