Caja Nuestra Gente

in the Peruvian

context

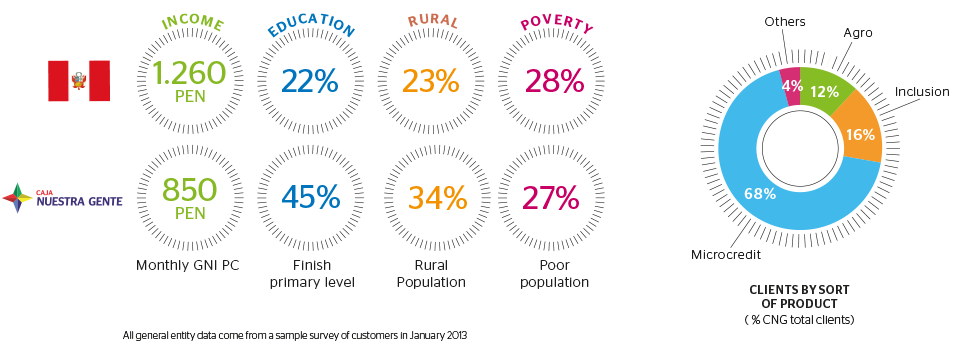

Caja Nuestra Gente (CNG) set up its business in August 2008. This entity supports the vulnerable population in 19 of the 24 existing departments in the country, by means of credits that allow them to undertake productive activities.

Nowadays, CNG has a total of 116 agencies, reason why it is the eighth financial entity and the second in the microfinance segment, as regards for the number of agencies. Nearly half of the CNG agencies are located in districts with more than 30% of poor population. 19% of these agencies are placed in districts whose poverty percentage exceeds 60% and where CNG and the Nation Bank are the only existing banking entities that undertake the objective of approaching the disadvantaged population.

CNG presence is really important in the departments of Tacna, La Libertad and Moquegua. In these departments it exists an approximate holding of 15% in the microcredit segment, and around 10% in the departments of Cajamarca, Arequipa, San Martin and Amazonas. In these departments, CNG assists the population with the lowest incomes. As this population is not assisted by traditional banking services, this entity helps them by means of financial products and services. CNG’s commitment is shown in the high number of vulnerable districts where this entity places its outstanding credit. This way, around 30% of CNG’s outstanding credit is located in districts with more than 30% of its population living in poverty. It is an important percentage compared to that of the Financial System, which is only 10%.

Its recent merger with Financiera Confianza will lead to the microfinance entity aimed at heading the rural microfinance in Peru. At the end of 2012, the merged entity will have presence in all Peruvian regions. It will have an approximate holding of 0.7% and 0.5% in the total amount of credits and deposits from the national financial system, respectively. This means that the entity is in the fourth place regarding to the microcredits segment, as it has a holding over 6% of the national total.

Florentina Gamboa

Florentina Gamboa

CNG’s portfolio is focused on credits for micro and small size enterprises and for the crop and livestock sector. This fact shows its commitment to support low-income people by means of productive finances.