BBVA Microfinance Foundation

in Colombia

BANCO DE LAS MICROFINANZAS, BANCAMÍA S.A, ran its business in Colombia in October 2008 after being set up by the BBVA Microfinance Foundation, and after the integration of the Corporación Mundial de la Mujer Bogotá and Corporación Mundial de la Mujer Medellín.

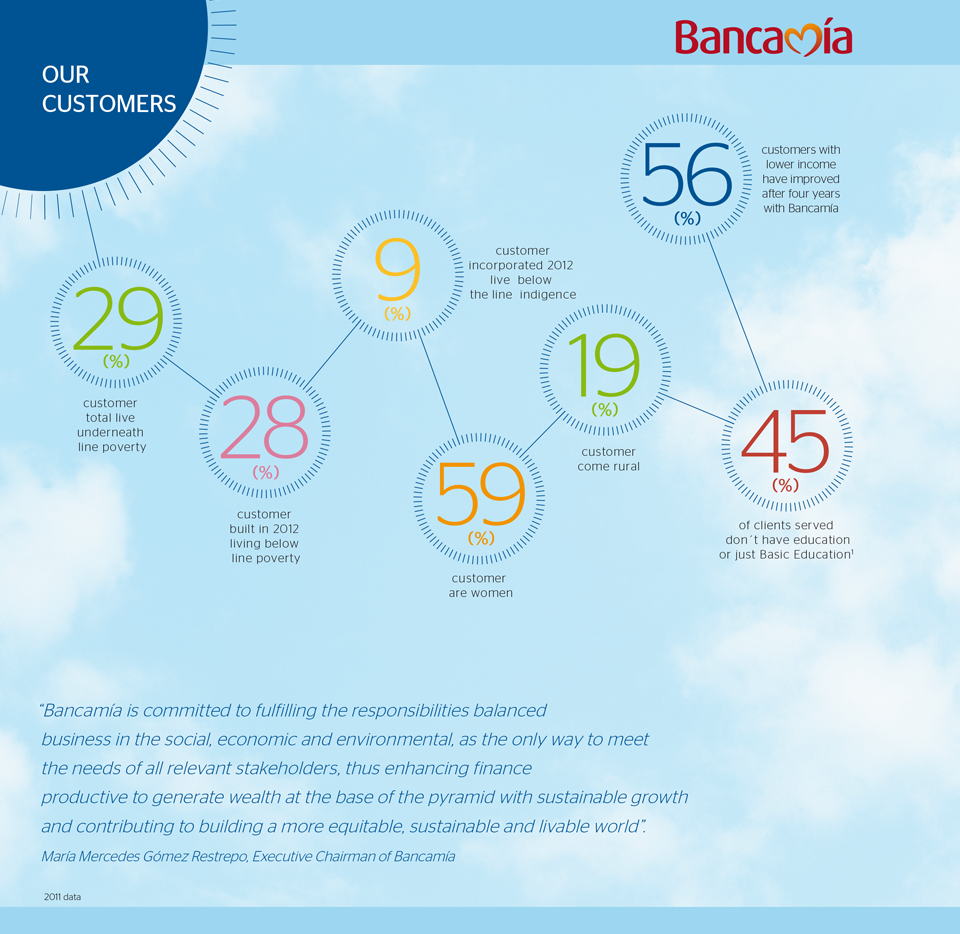

Nowadays, Bancamía is de biggest regulated microfinance institution in Colombia. It is still the microfinance private bank with the biggest amount of clients in the country, with the 28.19%. As a social bank which is specialized in microfinance, it offers a wide range of microfinance products and services to its clients, in addition to credit, savings, assurances, TDC... in order to meet its clients needs during their lives.

In 2012 Bancamía has supported 502,980 Colombian low-income entrepreneurs, 58.7% of them are women, whose average loan amount is $ 1,254.

the attention provided for entrepreneurs, beyond the

access and credit purposes, the proposal of value must

evolve and be fixed to the real needs, in order to generate

a fundamental improvement in their family’s and their own quality of life.

Margarita Correa Henao,

Bancamía Executive Manager

They are entrepreneurs who thanks to their imagination, enthusiasm and support given by Bancamía, have strengthened a little productive unite which has contributed to their families welfare in a sustainable way.

Moreover, Bancamía has received several prizes owing to its activity. Among them, it stands out the international initiative Smart Campaign, which has recognised Bancamía’s “Code of Ethics” among the “10 Best Microfinance Entities Codes of Ethics in the world”. It emphasizes its care and its guide to treat clients.

Lumedina Sánchez

Lumedina Sánchez