Bancamia in the Colombian context

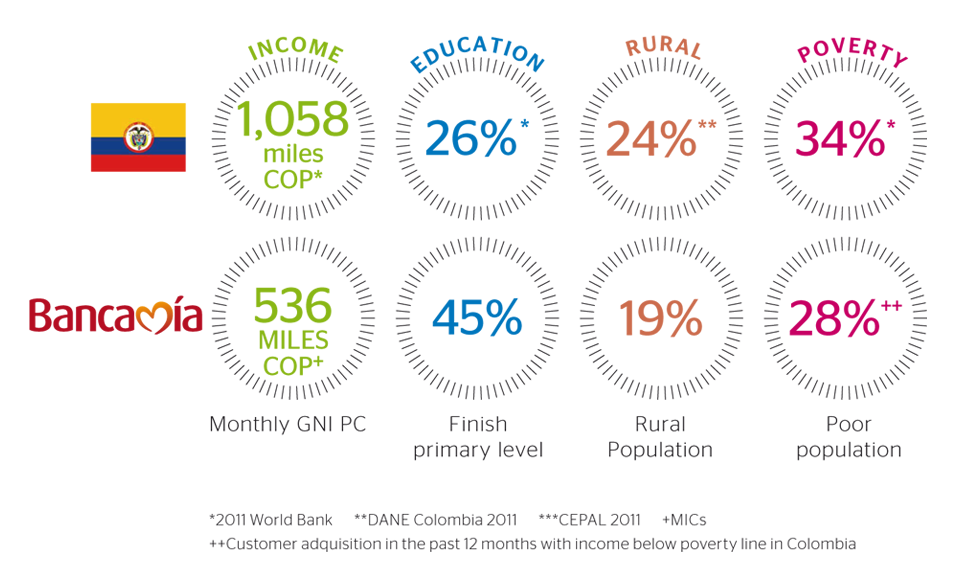

Bancamía Microfinance Bank focuses its attention to the economic and social development through productive finance. In this way, products and financial services are provided to the most disadvantaged people according to their needs. Bancamía Works with entrepreneurs whose incomes are below the monthly GNI per capita (its clients median income is 536,000 COP).

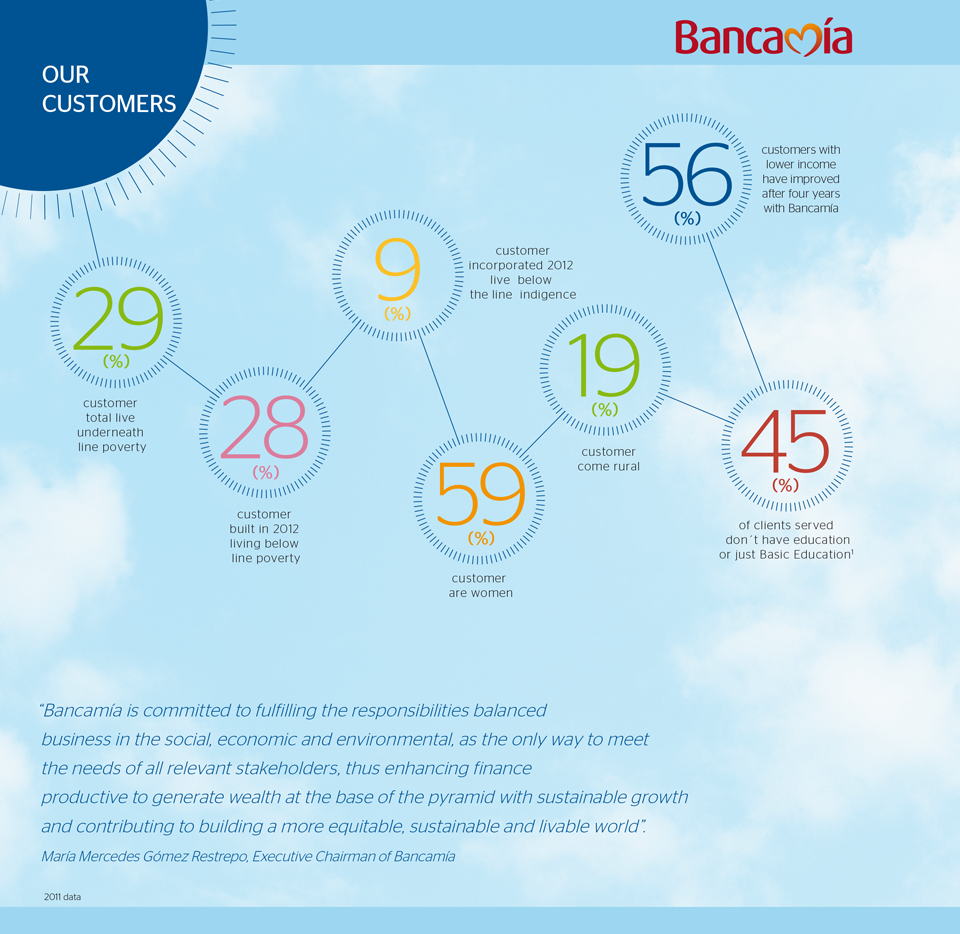

Furthermore, an important part of the customers attracted last year has incomes below the poverty line in the country (28%).

This economic vulnerable situation gets worst due to some clients characteristics, such as the low level of education shown in 45% of those who didn’t finish primary education. On the other hand, the financial exclusion of the clients stems from a low income situation and from geographical limitations. In order to lessen this financial exclusion Bancamía is trying to make an effort to assist those clients who live in remote areas. In Fact, almost 19% of the current clients live in rural areas where it is more difficult to gain access.

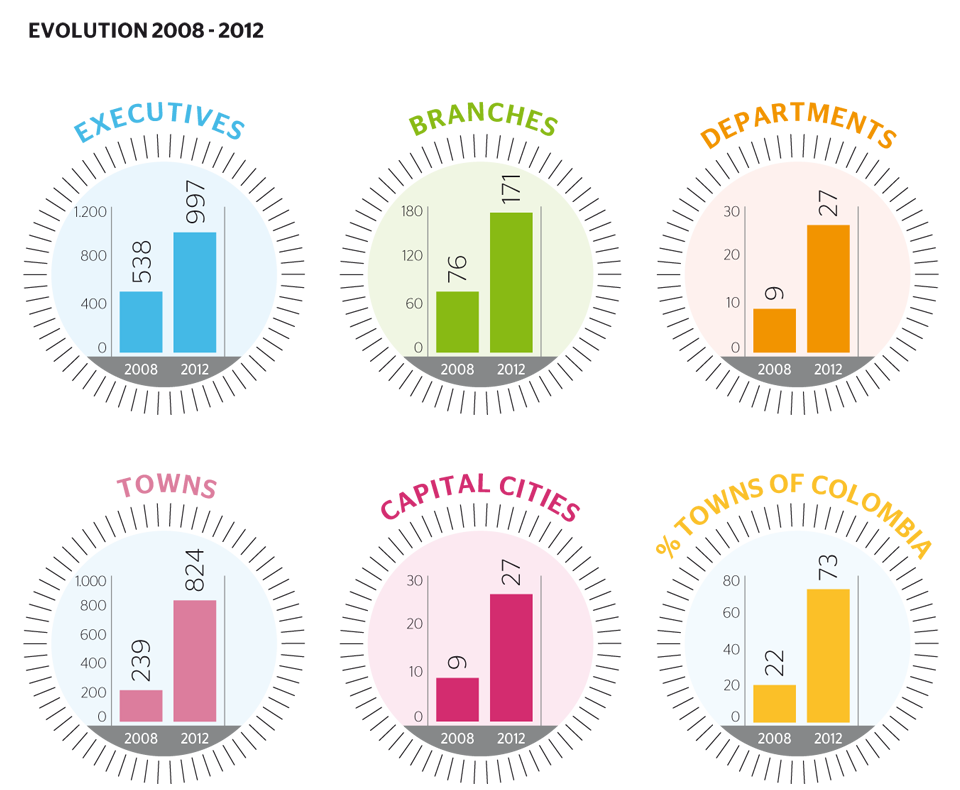

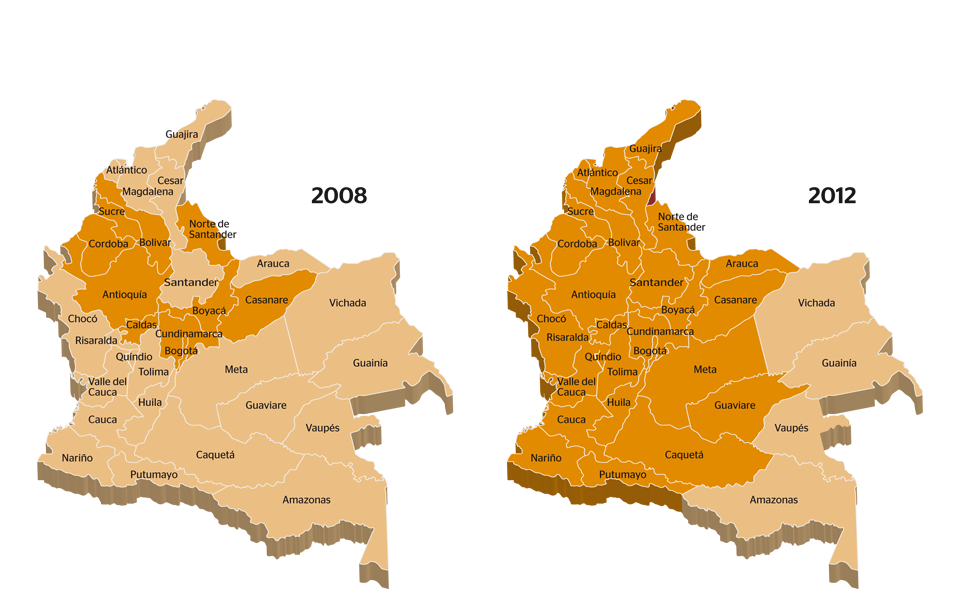

In 2012, it presents a geographic coverage in 824 municipalities and 27 departments. It also has 171 offices in the country, so it achieves to provide services to the regions that used to be excluded in financial terms.

As there has been an effort to gain access to these areas, there has also had an impact in the approach to saving products to people in areas where this kind of products designed according to their needs didn't use to exist. Thanks to this reason, Bancamía has now more than 300 customers with a savings account.