We support their businesses

The Foundation promotes the creation of entities regulated and supervised by the supervisory authority, the Superintendencia (The Office of the Superintendent of Financial Institutions). This way, we can offer an all-round support to our clients and not only credit services.

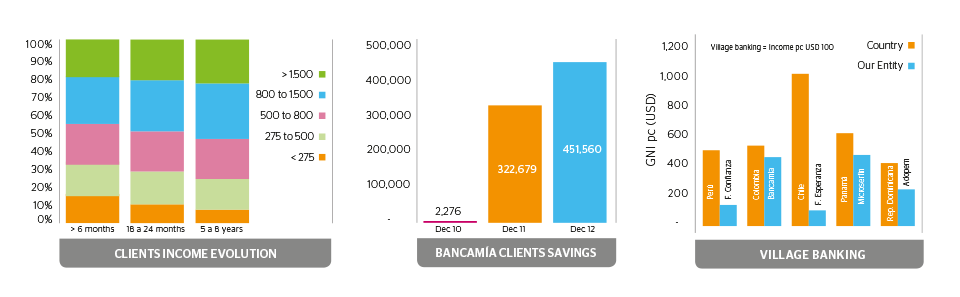

The experience has made us realized that poor people do have a savings culture, but not financial, as they are used to saving in an unofficial way by investing in tangible assets and tickets. Due to this reason, one of our objectives is aimed at encouraging the financial savings culture in order to help our clients guarantee their needs in the long term.

93% of the clients who work with entities that belong to the Foundation Group have the chance to gain access to all the financial products. The remaining 7% of our clients work with regulated but not supervised entities, as these ones are not licensed to take deposits yet.

The experience of our group will allow us to offer these clients solutions so they can also have access to other products in addition to microcredits.

For instance Bancamía began to offer liability products to its clients in December 2010. Since then, it has been offering specific savings products to those low-income clients by setting very basic requirements so as they could open a bank account; the duty of having a minimum balance appropriate to its clients savings ability (USD 6 for a natural person); and besides, they are not required to pay the expenses for operating the bank account. At the end of 2012 Bancamía had already attracted almost 500 thousand savers with low-resources.

In order to gain access to low-income entrepreneurs we also use group assistance. Thanks to the group methodology used by Fondo Esperanza and Financiera Confianza, we are able to gain access to entrepreneurs with incomes below USD 100/a month from Chile and Peru. We always use the group method as a way to gain access to these beneficiaries with the purpose that some day they will become individual clients, and able to turn their at first rudimentary economic activity, into a consolidated business.

Richard Bocardo with Aquiles Riqueros, client

Richard Bocardo with Aquiles Riqueros, client

John Philip McNally, with José Luis Llen and family

John Philip McNally, with José Luis Llen and family