We support vulnerable people

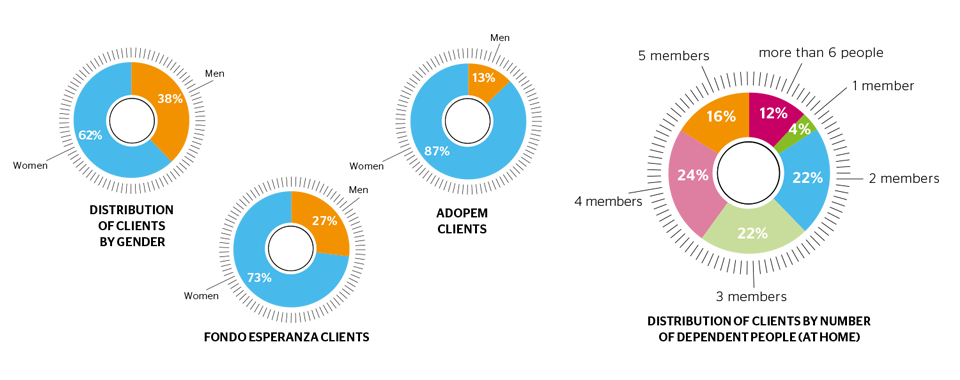

Some entities in the group have a high women percentage, such as Fondo Esperanza (Chile), with 87% of women, and ADOPEM Bank (Dominican Republic), where 73% of its clients are women.

In some other territories, special products have been tailored providing financial support to women, in order to adapt our services to their own needs. Such being the case of the product Palabra de Mujer, offered by Financiera Confianza, in Peru. This product is specially aimed at women short of resources by means of the group credit.

There are some factors adding vulnerability to our clients’ socioeconomic situation, such as their level of education and their available actual assets. Both factors bring about in the developed world an availability of assets (human in the education context, and actual in the housing context) that allow us to diversify the income sources, and use them as collateral in financial operations, and even to face periods without work or with lower incomes. These assets are not so common among microfinance clients, as they mean an additional vulnerability factor to their incomes situation.

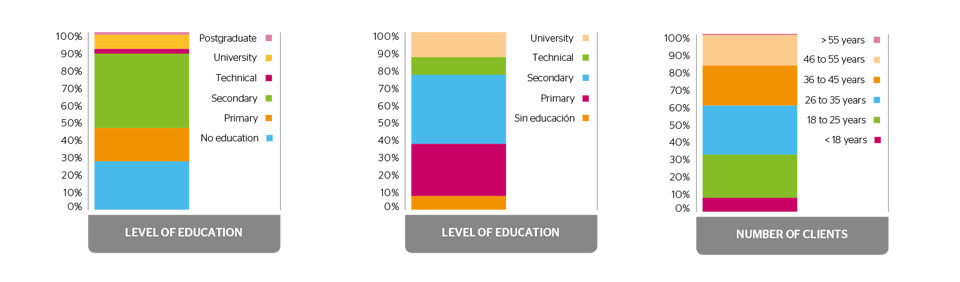

Most of our clients have a low level of education; 43% of our clients have no studies or have only completed primary studies; in the Dominican Republic 30% of our clients are illiterate. This low level of education makes them more vulnerable to crisis situations and more dependent on their business sustainability.

The family size is an essential factor to know the per capita income at the disposal of the client to support his family. Including the head of the family, almost 75% of the families have at least four members. For this reason, we have counted four people as the average family size to work out the per capita income.

The main part of the entrepreneurs that we assist has previous experience in their businesses. The median age of our clients is 41 years old, although more than 20% of them are between 26 and 35 years old.

Hernán Charparro y familia

Hernán Charparro y familia