BBVA Microfinance Foundation is working to form part of the digital transformation of financial services that has been taking place in the last few years, driving financial inclusion and improving its quality and sustainability. With the aim, always, of strengthening personal relationships with clients, to make these connections better and more efficient.

The relationship banking model used by the Group’s entities involves a physical presence along the length and breadth of the five countries where it operates and, furthermore, that we accompany clients throughout their lifecycle with the institution. This commitment, which is aligned with the Foundation’s mission, demands that innovation be at the service of the client, in order to create something tangible and of value.

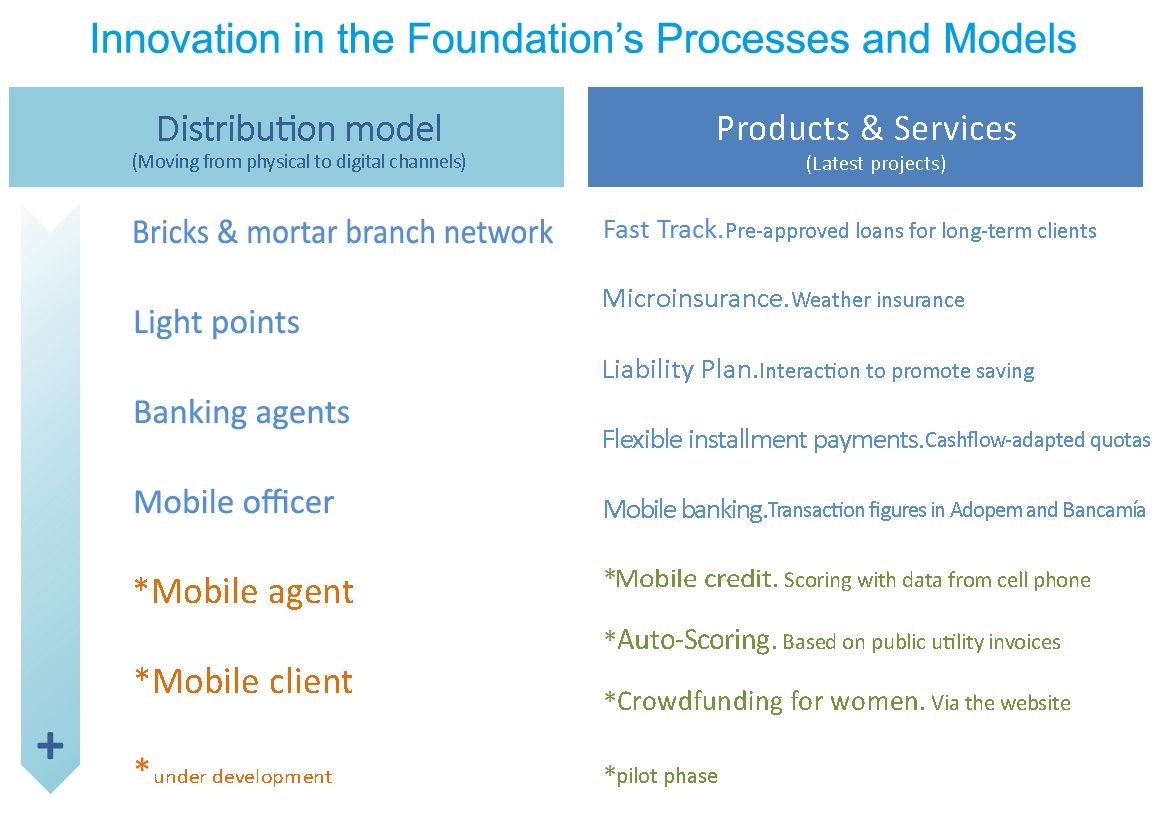

In order to comply with these aims, BBVAMF uses innovation for the purpose of:

- Diversifying products and services to serve the needs of all our clients

- Creating new distribution models to reach more people more efficiently

BBVAMF is leveraging innovation to humanize our client relationships with the financial and digital world with new products and services and more efficient distribution channels. The institution’s risk models are also evolving constantly. Thus, it provides its sales officers with more objective information that enables them to take better-informed decisions, while improving client response times.

To achieve this, BBVAMF follows a defined strategy of innovation:

- Continuous improvement of business processes, with particular attention to risk models

- Implementation of technology solutions developed in-house that underpin these processes

- Partnerships with fintechs that have cutting-edge solutions suited to microfinance

A Financiera Confianza’s officer with one of the entrepreneurs

Core banking is critical if we are to diversify products and services. This is the centerpiece housing all the institutions’ business information. It allows new products to be installed quickly and flexibly, so that we can look after different types of clients properly. It is a solution that has been designed specifically for microfinance, that configures risk tools and has a technology and functional architecture that means it can quickly provide services through different channels.

Another important component is the document manager: this management tool ensures that all documents associated with business process are digitized. This eliminates the cost of handling documents physically and makes it easier to access them, since they are stored in the cloud.

Furthermore, in order to reach more people more efficiently, BBVAMF Group has changed its distribution model from one of traditional branch offices to a multi-channel offering, with complementary channels, both physical and virtual, supporting its commercial activity.

It’s particularly important the development of digital channels in the distribution models. The strategy defined for these identifies three distinct priorities:

- The officer’s mobility, so that he or she can work directly with the client in the latter’s domicile, whether there is a network available or not.

- the mobility of own agents, so that all branch operations can be taken to any sales point the institution chooses.

- the mobility of clients or mobile banking, to support clients’ digitisation and minimize the risk of transporting cash; as well as providing support in the purchase of non-banking services, financial education, relevant local information, a direct channel for communicating with their manager, etc.

Our business model involves getting to know our clients and their needs better. The development of products and services such as flexible payments, educational credit, home improvement credit, microfranchises, microinsurance andliability products to encourage saving, are all part of our search to respond effectively to the expectations and needs of each of our client segments.

Constant innovation means that we can reach more clients and improve our service. That is why innovation is in our DNA.