interview

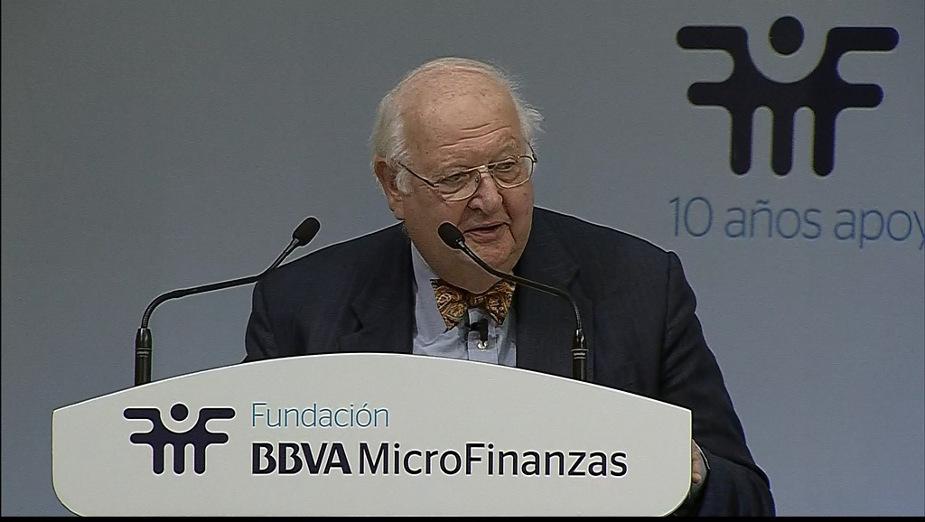

Sir Angus Deaton, Nobel Memorial Prize in Economic Sciences

Professor Sir Angus Stewart Deaton is a microeconomist specializing in empirical issues. He was born in Scotland and is now both an American and a British citizen. He has been working in the United States for almost 35 years.

The methods and techniques of MicroFinance are a kind of useful knowledge that can benefit poor people worldwide.

He graduated from Cambridge University, where he wrote his Ph. D. thesis, Models of consumer demand and their application to the United Kingdom, and was later awarded a fellowship at Fitzwilliam College. He worked for seven years in the Department of Applied Economics in this university.

He was professor of Econometrics at the University of Bristol, before moving to Princeton University in 1983. There, he is the Dwight D. Eisenhower Professor of Economics and International Affairs Emeritus, in the Woodrow Wilson School of Public and International Affairs and in the Economics Department.

In 1978, he was the first ever recipient of the Frisch Medal, an award given by the Econometric Society every two years, for applied (theoretical or empirical) research published within the previous five years in its journal, Econometrica. He is a Fellow of the Econometric Society, a Fellow of the British Academy, an Honorary Fellow of the Royal Society of Edinburgh, a Fellow of the American Philosophical Society, and a member of the National Academy of Sciences of the United States. In 2009, he was President of the American Economic Association.

In 2011, he won the BBVA Foundation Frontiers of Knowledge Award for Economics, Finance and Management, for his central contributions to the theory of consumption and savings and to the measurement of economic wellbeing. His current research focuses on poverty, inequality, health, wellbeing, and economic development, and he has recently co-authored publications on mortality and morbidity with his colleague and wife, Professor Anne Case. In 2013, Deaton published his acclaimed book, The Great Escape: health, wealth, and the origins of inequality.

In 2015 he was awarded the Nobel Memorial Prize in Economic Sciences for his analysis into the workings of demand, consumption and income, poverty and welfare.

-

Professor Deaton, you have recently attended the BBVA Microfinance Foundation Forum on Financial Inclusion and Development as a keynote speaker. How was the experience? What, in particular, caught your attention?

I was greatly impressed by the size of the gathering, and by the attention and evident interest of the audience. The four people from Latin America (clients of the BBVA Microfinance Foundation in Chile, Peru, Colombia and the Dominican Republic) were very interesting, and made the session very lively and very real. And H. M. the Queen was extremely gracious and clearly deeply involved in the meeting and the projects.

-

What were the key messages in your speech?

My message was that the world is much better off today than in the past, though development is never continuous. We live longer and are richer. This came about because of the power of reason, and particularly from the invention and spread of useful knowledge. I argued that the methods and techniques of microfinance are a kind of useful knowledge that can benefit poor people worldwide.

-

When did your interest in Economics and Econometrics really start? And what triggered this interest?

When I was a student at Cambridge in the 1960s, I started applying the mathematics that I knew to economics and econometrics. Like many at that time, I read Samuelson’s text*, and was captured by its applicability to real life and to improving the lives of people.

-

What would you consider to be your most important conceptual contribution, Professor Deaton? How did this idea influence your subsequent research?

I have many favourites, and it is hard for me to choose. I might single out my work on how inequality cumulates over the life cycle, and how luck turns into inequality. That was work with Christina Paxson, and we wrote several papers around those ideas.**

-

What has been, for you, the most unexpected and surprising result of your research? Why?

Perhaps what became known as the “Deaton Paradox” that the permanent income hypothesis implied that consumption was less smooth than income, even though it had been invented to explain precisely the opposite. It is difficult to abandon something that you have long believed was true, and very satisfying when you eventually figure out what is going on. I would say much the same on my work with Christina Paxson on food paradoxes, and that the statement that Engel made about family size and the food share was not only not obvious, as had been previously thought, but it was a paradox that made no sense!***

-

The BBVA Microfinance Foundation has emphasized the supply of savings deposit facilities and of insurance, in addition to credit. In your early research you focused on the importance of consumption smoothing and on the prevalence of precautionary savings among the poor. How much does the role of financial institutions in offering safe and convenient tools to facilitate these processes matter?

It matters a lot! Households need to be able to move resources through time, and they need to have insurance against risk, and financial institutions allow them to do both of those things in a way that would be hard or impossible without them.

-

In your recent book and in other occasions, you have acknowledged your interactions with Professor Amartya Sen. Would you tell us what are the most important ways in which Professor Sen has influenced your work?

He has always emphasized the ethical and philosophical issues in economics, and that has been important to me.

-

Would you consider financial inclusion to be one of the “freedoms” that Professor Sen associates with development? What would be the contribution of financial inclusion from this perspective?

I think of financial inclusion as one of the tools, or part of the infrastructure, that makes people’s lives better, and thus enhances their freedom.

-

In measuring poverty and wellbeing you have used unconventional indicators, such as health, height or happiness. What brings economists to talk about happiness? To what extent do you believe that this approach adds as a guide to policymaking?

Economists have always talked about “utility,” and historically utility and happiness are the same thing. We have lost that, and it is well worth the effort to try to bring it back.

-

What are the actual, deeper causes of poverty, Professor Deaton? From this perspective, what could be done to alleviate poverty?

The deep cause of poverty is lack of freedom. We need to bring to bear the tools to make people free, especially useful knowledge. Some can be transmitted from one place or time to another, but much has to be worked out by countries and individuals on their own.

-

Is the incidence of world poverty actually declining? Is this an irreversible trend?

Yes, and I hope so.

-

Is inequality an inherent part of progress? If so, what should be done about it, in order to lessen the potential social harm from inequality while not destroying its positive incentive effects?

Yes, inequality is usually inherent in progress. The key is to make sure that no one gets left behind for too long. That requires good institutions, and good use of knowledge.

-

In general terms, where are we headed? Are you pessimistic or optimistic about the future?

I hope we are headed onwards and upwards, as in the past. So I am optimistic. But past performance is no guarantee of future performance, as the financiers have to tell you!

* Paul A. Samuelson, Foundations of Economic Analysis Harvard University Press, 1947 and 1983.

** Angus Deaton and Christina Paxson, “Intertemporal choice and inequality”, Journal of Political Economy, 1994.

*** Angus Deaton and Christina Paxson, “Economies of scale, household size, and the demand for food”, Journal of Political Economy, 1998.