Contigo Microfinanzas

in the Argentinian context

Contigo Microfinanzas began its microfinance activity in order to face socioeconomic inequalities and the lack of opportunities, and it opts for Microfinance as a tool in the fight against poverty through the access to productive financing.

The microfinance market in Argentina is quite new compared to other Latin American markets. This is the reason why this market is characterized by its poor development and low reception, as it is proved in the volume of outstanding credit and number of clients.

The access to Microfinance offers a chance to job creation and diminish the vulnerability to poverty in those affected people.

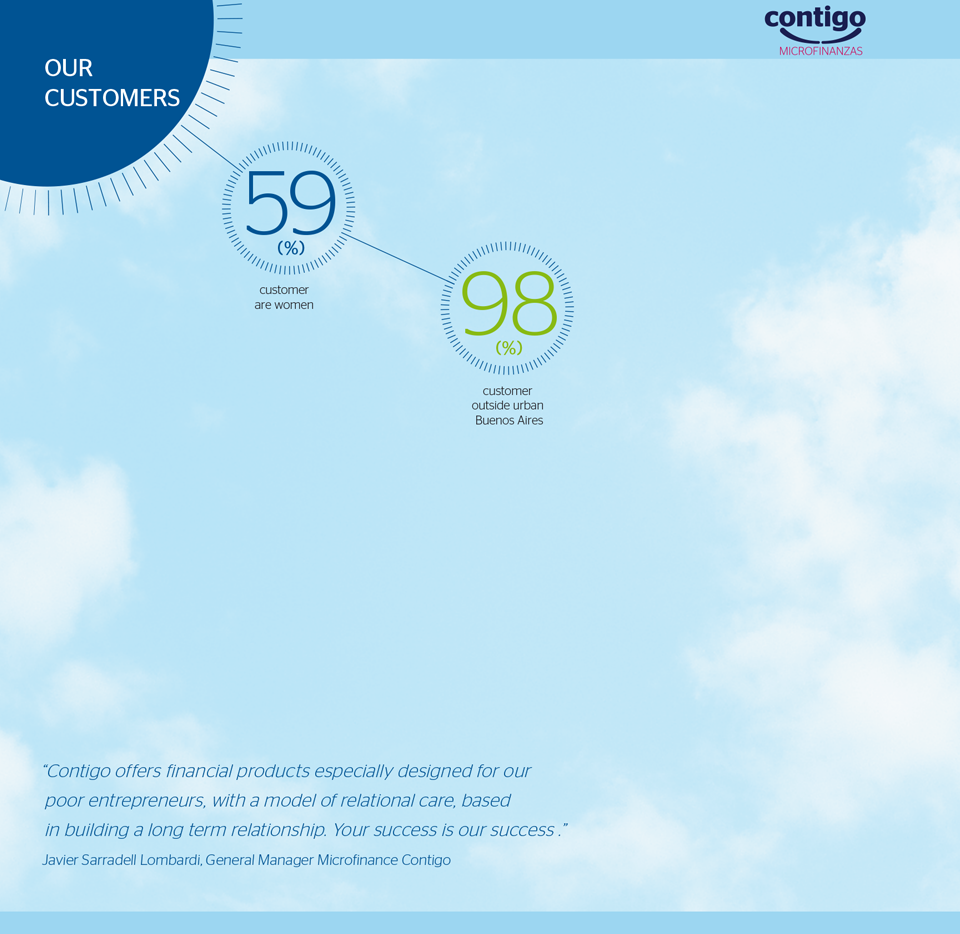

Contigo Microfinanzas’ presence in Argentina impacts mainly on rural poverty and city centres out of "Gran Buenos Aires", (where the remaining microfinance entities are focused), and where the so-called “new poor people” are placed. These new poor people have to face up to a complex labour market. In most cases they have to carry out precarious jobs in an informal sector. That’s why microcredit means an alternative to generate incomes with some kind of stability and in a sustainable way in the long term.

Contigo Microfinanzas is focused on those sectors placed at the base of the social pyramid.

To a lesser but increasing extent, Contigo also assists rural microentrepreneurs – an important fact because as Argentina is mainly a urban country, rural areas are usually kept out.

The entity directs all its efforts to assist with specific products and services the microentrepreneurs working in the agriculture and livestock sector. This sector, whose incomes come from agricultural and stockbreeding activities, has the objective to develop product s aimed at small producers who have been excluded from the traditional financial services.

María Nahuelquin

María Nahuelquin