& track record

poverty

realities

the future

Sustainable inclusion:

finance at the service of households

Purpose

& track record

The sustainable development of people in vulnerability working in productive activities

To foster entrepreneurs’ inclusive and sustainable development it is essential to stay by their side, providing access to loans, insurance, savings products, training, support networks and advice. We call it Productive Finance, the most important tool needed to achieve our purpose.

Our strategic priorities are:

& social inclusion

empowerment

sustainability

To maximize impact and align it with our purpose, we trigger two levers that always underpin our work.

Digitalization

Impact measurement

Client data to 12.31.2021, by institution

Loan portfolio

+6 % ↑

Client funds

-7 % ↓

Sum disbursed

+34 % ↑

Average loan

0,5 % ↑

7.619

Employees

559

Branches

express offices

1.847

Own banking

agents

98.108

Transaction

points

Multidimensional

poverty

We analyze household wellbeing in depth, assessing the deprivations they face

What do we want to achieve?

To understand the entrepreneurs’ households along multiple wellbeing dimensions, over time

To link this information with our value proposition: products and services that meet these needs

Partnership with SOPHIA Oxford

This enables us to create

a multidimensional poverty index adapted to our clients

The definition is based on nine indicators that capture three dimensions of poverty:

Households with deprivations, by indicator

Percentage of households with deprivations

The surveys show that the deprivations most commonly suffered by our entrepreneurs are the number of years of schooling, inadequate sanitation and limited access to water.

- There are also shortfalls in their housing materials and internet access

- 24% of households are in multidimensional poverty

Post-COVID

realities

To mentor, support and reactivate

We support reactivation as a way of achieving our mission

Good quality, sustainable microloans

We adjust our loan policies progressively so that they match the new realities, supporting them as they grow and recover in an orderly fashion, in a higher-risk scenario.

We provide solutions for the hardest-hit clients

Moving forward without leaving anyone behind

To provide the most appropriate and sustainable solution, we analyze each case, adjusting our methodology to the different rates of recovery and the maturity dates of the posponed loans. We have also designed new, more flexible payment terms

We adapt to a new, changing scenario

Scaling our support capacity with new tools and infrastructure

- We develop and incorporate new standardization and digitalization tools into our systems in record time.

- We make full use of technology to manage our clients’ needs.

- We reinforce the management of operational risk and business continuity.

We are mentoring and supporting the hardest hit clients with tailor-made solutions that enable them to meet their obligations even when their activity has contracted

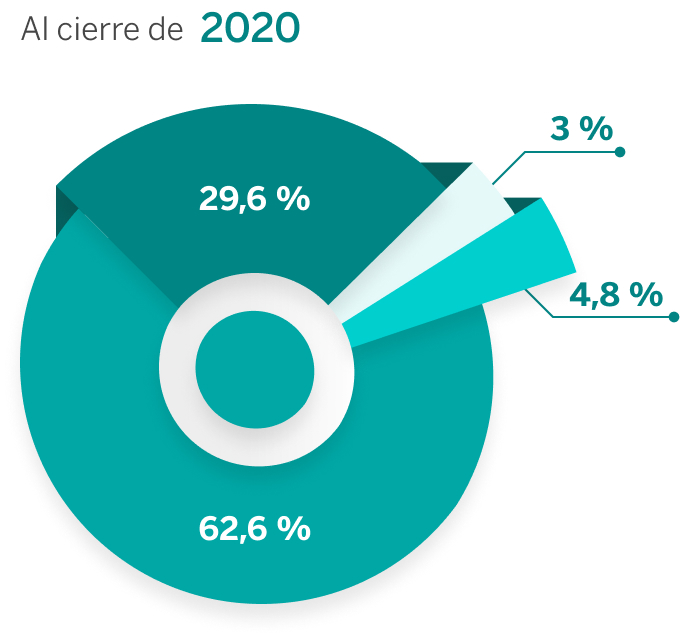

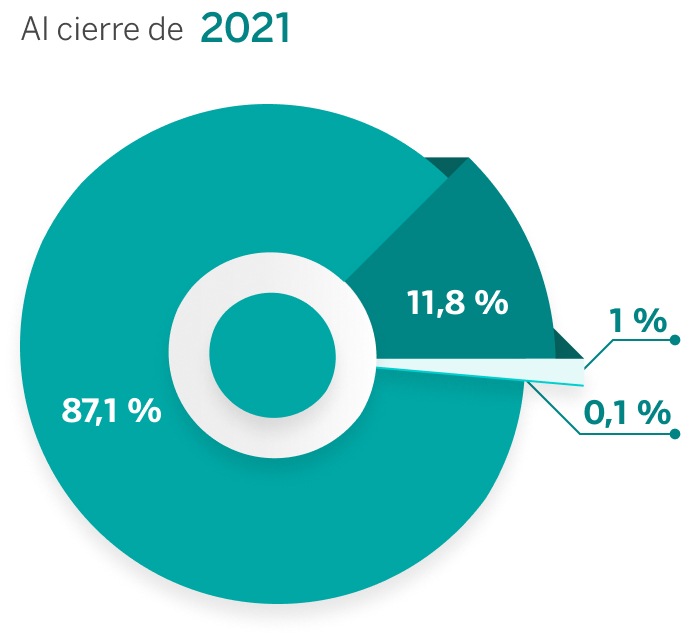

Loan book breakdown

- Performing loans

- Performing loans receiving financial solutions, now completed

- Restructured or refinanced loans

- Loans in grace period

Clients with support solutions

600.173

502.903

We have adapted our methodologies and processes to offer financial resources to support their economic recovery

Number of credit clients

Solutions

for the future

We innovate with digital solutions, designing initiatives to reduce the gender gap and mitigate the effects of climate change

Household wellbeing

By protecting health, we are protecting homes

- Insurance for serious illness

- Physical and mental healthcare cover and legal aid

- 179.575 insured parties

We are sowing the seeds of education for the future

- 594.614 people received training and financial advice

Safer, sustainable and hygienic housing

- 38.002 people took out loans to upgrade their homes

- Credits and professional advice on how to build housing with sustainable materials

- Financing to bring sanitation into their homes

An integrated approach to serving women

Digitalization for progress

Internet - Taking connectivity to remote areas

- 6 connection points in 2021 - 56 by 2022

- Financial and non-financial education

- Over 2,000 people benefited

Biometric solutions

- Subscribing to digital channels using new ways of identifying and authenticating clients, such as facial or voice biometrics, and other processes such as digital signature

- Top quality safety and convenience so that entrepreneurs can choose when and where to carry out their transactions

Digital channels

- Increase in the take-up of channels

- We went from 700 to nearly 2,000 proprietary banking correspondents in 2021

- and +390,000 registered users on the client app/web

COMMITMENT TO THE ENVIRONMENT

- Reducing our carbon footprint: 0.36 TN CO2/employee

- Reducing our consumption of water, paper & electricity

- Sustainable offices (in pilot phase)

- Training for loan officers & clients

GREEN FINANCE

- 7 lending and insurance products for adaptation to and mitigation of climate change

CLIMATE VULNERABILITY

- 2 climate vulnerability indicators (in pilot phase)

Resilience &

Digital poverty

In the wake of COVID-19, we are measuring the resilience of entrepreneurs and their digital poverty

Resilience *

- Validating clients’ progress/recovery

- Assessing the sustainability of their business adaptations

- Assessing interest in financial/non-financial solutions

Digital poverty

- Connectivity, plus

- Affordability

Countries in the

what we operate

The social performance of entrepreneurs, detailed by country

Measure realities that

drive dreams

Bancamía is a leading entity in its country with more than a million clients that remains firm in its support to improve the quality of life of those who are in a situation of vulnerability. In 2021, it has managed to serve more than 99,000 new credit clients and stands out for its focus on rural areas and the enormous recovery capacity of its entrepreneurs.

The Social Performance Report shows the progress of entrepreneurs who attends, its financial relationship and the implications it has on the home. It also includes the analysis of non-monetary dimensions, which allows a broader vision of the home, knowing the structural challenges they face: deficiencies in housing, education and health.

Generating opportunities, we progress with people

Financiera Confianza is an entity with a presence throughout the Peruvian territory with a complete offer of financial and support products to improve the income and quality of life of around 700,000 entrepreneurs. It maintains high standards of inclusion with more than 34,000 bank users during 2021 and with a special focus on young entrepreneurs. Its clients have shown an enormous capacity for reactivation.

The Social Performance Report shows the progress of the entrepreneurs it serves, their financial relationship and the implications it has on home. In addition, it includes an analysis of non-monetary dimensions that allows a broader vision of the home, knowing the structural challenges they face: deficiencies in housing, education and health.

Effort and creativity, the ingredients of success

With more than 408,000 clients, Banco Adopem maintains its commitment to serving vulnerable people in society through its financial products and services, highlighting its ability to incorporate them into the formal financial system. Its nearly 1,300 employees work throughout the country to support entrepreneurs in their recovery.

The Social Performance Report shows the progress of entrepreneurs who attends, its financial relationship and the implications it has on the home. It also includes the analysis of non-monetary dimensions, which allows a broader vision of the home, knowing the structural challenges they face: deficiencies in housing, education and health.

Empowering them to go further

Fund Hope is the largest solidarity entrepreneurship community in Chile. It serves more than 109,000 people, most of them women. It brings together entrepreneurs, offers financial services and promotes training and the generation of support networks, with the aim of improving their living conditions, that of their families and their communities.

The Performance Report Social shows the progress of the entrepreneurs it serves, their financial relationship and the implications it has on the household. It also includes the analysis of non-monetary dimensions, which allows a broader vision of the home, knowing the structural challenges they face: in terms of housing, education and health.

One business, many impacts

Microserfin serves more than 17,000 entrepreneurs and remains firmly committed to the sustainable development of their families and society in the Panamanian environment. His work in neglected and rural areas stands out. More than 5,800 people are new clients and 56% of these have been banked by the entity.

The Social Performance Report shows the progress of the entrepreneurs it serves, their financial relationship and the implications it has on home. It also includes the analysis of non-monetary dimensions, which allows a broader vision of the home, knowing the structural challenges they face: deficiencies in housing, education and health.

Countries where

we operate

Entrepreneurs’ social performance, broken down by country

Measuring realities that make dreams come true

Bancamía is a leading institution in its country with over a million clients, that remains true to its support for improving the living standards of the most vulnerable. Serving over 99,000 new lending clients in 2021, it places special emphasis on rural areas, together with its entrepreneurs’ enormous capacity to recover.

The Social Performance Report shows the progress being made by the entrepreneurs we serve, their financial circumstances and the implications these have on their households. It also includes our analysis of the non-monetary dimensions, which makes it possible to have a broader understanding of their households, understanding the structural challenges they face: shortfalls in housing, education and healthcare.

2022

Colombia Report

Generating opportunities, we make progress with people

Financiera Confianza is present throughout Peru, offering a comprehensive financial product range and mentoring to raise the incomes and living standards of around 700,000 female and male entrepreneurs. It has high standards of inclusion, with over 34,000 people banked during 2021 and a particular focus on young entrepreneurs. Its clients have shown an enormous capacity to get back on their feet.

The Social Performance Report shows the progress of the entrepreneurs the institution serves, their financial circumstances and the implications these have on their households. It also includes our analysis of the non-monetary dimensions, which makes it possible to have a broader understanding of their households, understanding the structural challenges they face: shortfalls in housing, education and healthcare.

2022

Peru Report

Effort and creativity, the ingredients for success

With over 408,000 clients, Banco Adopem is sticking to its commitment to serve the most vulnerable people in society by means of its financial instruments, with notable success integrating them into the formal financial system. The bank’s approximately 1,300 employees work the length and breadth of the country to support entrepreneurs in their recovery.

The Social Performance Report shows the progress of the entrepreneurs the institution serves, their financial circumstances and the implications these have on their households. It also includes our analysis of the non-monetary dimensions, which makes it possible to have a broader understanding of their households, understanding the structural challenges they face: shortfalls in housing, education and healthcare.

2022

Dominican Republic Report

Empowering, so that they go further

Fondo Esperanza is Chile’s biggest cooperative entrepreneurial community. It serves over 109,000 people, most of them women. It brings together people who run enterprises, offering them financial services, promoting training and the creation of support networks, with the aim of improving their living conditions, those of their families and their communities.

The Social Performance Report shows the progress of the entrepreneurs the institution serves, their financial circumstances and the implications these have on their households. It also includes our analysis of the non-monetary dimensions, which makes it possible to have a broader understanding of their households, understanding the structural challenges they face: shortfalls in housing, education and healthcare.

2022

Chile Report

One business, many impacts

Microserfin serves over 17,000 entrepreneurs and remains firm in its commitment to the sustainable development of their families and their communities in Panama. They are particularly active in regions that have few services, especially rural areas. Over 5,800 people are new clients and 56% of these have been banked by the institution.

The Social Performance Report shows the progress of the entrepreneurs the institution serves, their financial circumstances and the implications these have on their households. It also includes our analysis of the non-monetary dimensions, which makes it possible to have a broader understanding of their households, understanding the structural challenges they face: shortfalls in housing, education and healthcare.

2022

Panama Report

Full reports

Activity

report

This report summarizes the Foundation’s activity in 2021. It presents a brief review of entrepreneurs’ performance and the deprivations in their households, before explaining in greater detail the solutions offered by the Foundation’s institutions to better mentor their entrepreneurs.

Social

Performance Report

This report covers the region’s macroeconomic context and that of the research carried out, in order to analyze and track the progress of the entrepreneurs we serve. On the one hand it specifies the performance of these entrepreneurs’ businesses, and the impact of this on their households. On the other it digs deeply into the multidimensional shortfalls and needs of households, research that began in 2021. Finally, it describes our alignment with ESG indicators and Sustainable Development Goals.