claim not to have

a regular monthly

income

The potential for more saving does exist.

of clients have the

capacity to generate

modest savings

to create incentives for good

habits and increase

financial know-how

people received

financial education

in 2019

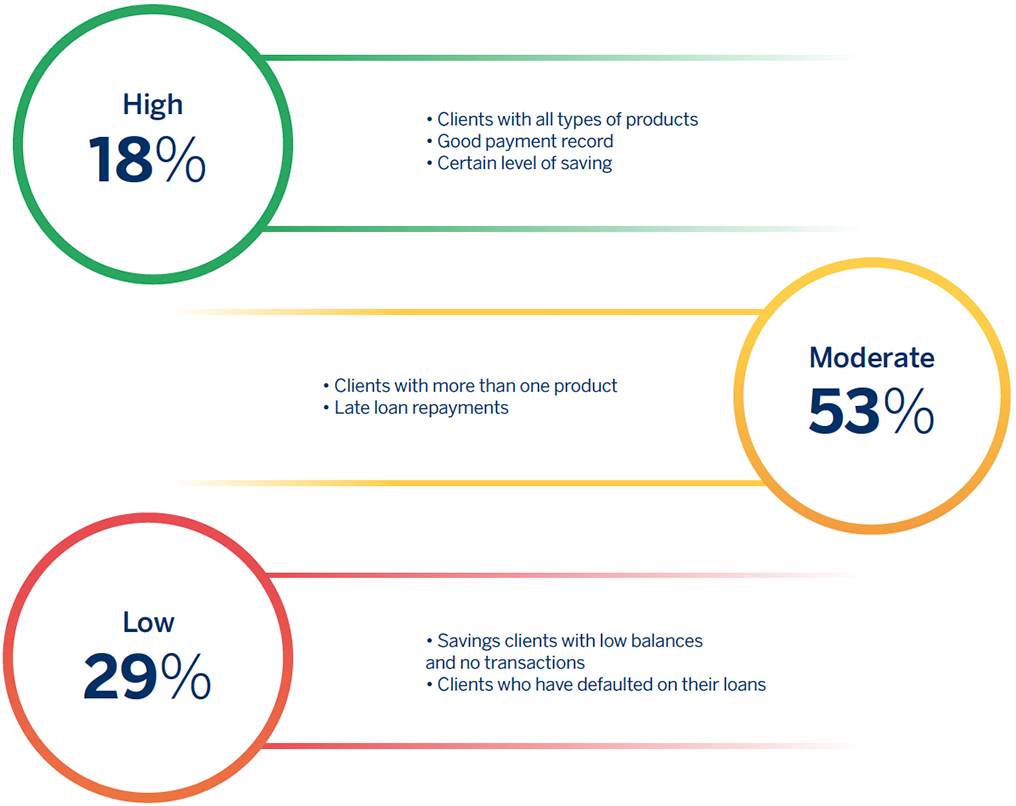

To measure financial health, we have built

an indicator that looks at four client dimensions: